DAP Incoterm, short for Delivered at Place, is a widely used international shipping term that defines the responsibilities of buyers and sellers in cross-border transactions. Under DAP, the seller is responsible for delivering goods to a specified location—such as a warehouse, port, or distribution center—while the buyer handles import duties, taxes, and unloading. This Incoterm offers a balanced approach to global trade, giving sellers control over transport logistics and buyers authority over customs clearance. In this article, we’ll explore what DAP Incoterm means, how it works, and when it’s the best choice for your business.

What Does DAP Incoterm Mean?

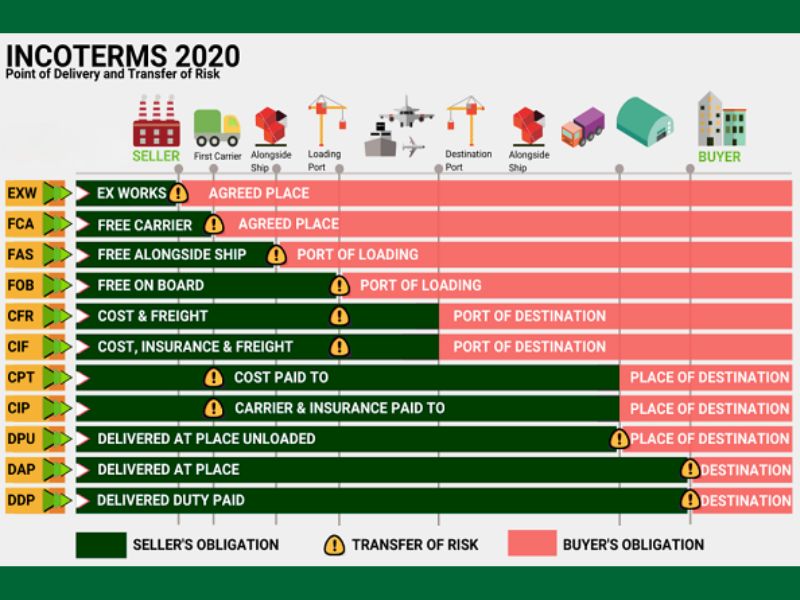

DAP Incoterm, which stands for Delivered at Place, is a commonly adopted term in global shipping that helps streamline international trade. Established by the International Chamber of Commerce (ICC) under the Incoterms 2020 framework, DAP clearly defines the roles of both buyers and sellers throughout the shipping process. It provides clarity by specifying who is responsible for transportation, customs procedures, and risk management at each phase of delivery, making cross-border transactions more efficient and predictable.

Under this term, the seller is responsible for delivering the goods to a named destination—whether that’s a warehouse, port terminal, or buyer’s facility. The buyer, on the other hand, takes over once the goods arrive, handling import duties, taxes, and unloading. This division of responsibility makes Delivered at Place incoterm a flexible and buyer-friendly option, especially for companies that prefer not to manage international freight logistics.

Responsibilities Under DAP

Understanding the division of responsibilities under Delivered at Place is crucial for avoiding confusion, delays, or unexpected costs. Let’s break it down by party:

Seller’s Responsibilities

Export Customs Clearance

The seller must handle all export formalities, including documentation, inspections, and customs declarations. This ensures the goods can legally leave the country of origin.

Freight and Delivery to Named Destination

The seller arranges and pays for transportation to the agreed-upon destination. This includes inland trucking, ocean freight, or air cargo—depending on the shipping route. For example, if a Vietnamese supplier is shipping woven fabric to a customer in Germany under DAP, the supplier must cover all costs until the fabric reaches the buyer’s warehouse in Berlin.

Risk Transfer Point

Risk transfers from the seller to the buyer once the goods are made available at the named destination. If damage occurs during unloading, it’s the buyer’s responsibility—not the seller’s.

Buyer’s Responsibilities

Import Customs Clearance

The buyer is responsible for clearing the goods through customs in the destination country. This includes submitting import declarations, paying applicable duties, and complying with local regulations.

Duties and Taxes

All import-related charges—such as VAT, tariffs, and excise taxes—are paid by the buyer. These costs can vary widely depending on the destination country and type of goods.

Unloading at Destination

Once the goods arrive, the buyer must arrange for unloading. This could involve forklifts, labor, or specialized equipment, depending on the nature of the shipment.

When to Use DAP Incoterm?

DAP is ideal in scenarios where the buyer wants the seller to manage the complexities of international transport but prefers to retain control over import procedures. It’s commonly used in:

- B2B transactions involving industrial goods

- Shipments to remote or inland destinations

- Deliveries where the buyer has established customs clearance processes

For example, a company importing UN-certified bulk bags for hazardous materials may choose DAP to ensure the bags are delivered directly to their facility, while they handle the import compliance themselves.

Key Considerations and Limitations

While DAP offers convenience, it’s important to understand its limitations:

- Unloading Not Included: The seller delivers the goods, but unloading is the buyer’s responsibility. Miscommunication here can lead to delays or damage.

- Import Duties and Taxes: These are not covered by the seller. Buyers must budget for these costs.

- Access to Destination: The seller must ensure the delivery location is accessible. If the destination is remote or lacks infrastructure, additional coordination may be needed.

Clear communication and detailed contracts are essential to avoid misunderstandings under Delivered at Place incoterm.

Documentation Required for DAP

Proper documentation ensures smooth execution of DAP shipments. Key documents include:

Commercial Invoice

Details the transaction, including product description, quantity, price, and Incoterm used.

Bill of Lading or Airway Bill

Serves as proof of shipment and outlines the transport route. It may also be required for customs clearance.

Export Clearance Documents

Includes export licenses, certificates of origin, and any other documents required by the country of origin.

Delivery Confirmation

Once the goods arrive, a delivery receipt or confirmation is signed by the buyer to acknowledge receipt.

FAQ About DAP Incoterms

Who Pays Duty in DAP Incoterm?

The buyer pays all import duties, taxes, and customs fees. The seller’s responsibility ends at delivery.

Is DAP or DDP Cheaper?

Delivered at Place incoterm is generally cheaper for sellers, as they don’t cover import duties. For buyers, DDP may be more convenient but often comes at a higher cost due to the seller’s added responsibilities.

Who Clears Customs for DAP?

The buyer is responsible for import customs clearance. The seller handles export clearance only.

What Is the Difference Between DAP and CIF Incoterms?

CIF (Cost, Insurance, and Freight) applies only to sea shipments and transfers risk at the port of destination. DAP applies to all transport modes and transfers risk at the final delivery point. CIF includes insurance; Delivered at Place does not.

Conclusion

DAP Incoterm—Delivered at Place—is a versatile and widely used shipping term that clearly defines the roles of buyers and sellers in international trade. It allows sellers to manage transportation and export formalities while giving buyers control over import procedures and final unloading. This balance of responsibility makes DAP a flexible and buyer-friendly option for many global transactions.

Consult your reliable supplier like EPP VIETNAM to ensure your shipments are compliant, cost-effective, and delivered with precision. EPP VIETNAM also offers high-quality fibc bags, woven fabric, PP woven bags and agricutlural films and certified packaging solutions tailored to your industry needs. Reach out today to explore how we can support your global trade operations.